What Event Changed Jeffery s World Again on Dec 30th

By Chair Cecilia Rouse, Jeffery Zhang, and Ernie Tedeschi

Introduction

Supply chain disruptions are having a substantial bear upon on electric current economic conditions. Economy-wide and retail-sector inventory-to-sales ratios have hitting record lows; homebuilders are reporting shortages of key materials; and automakers do non accept enough semiconductors. Elevated consumer need is adding fuel to the fire. Travel demand, for example, has returned much more sharply than expected, which is straining airline operations. Similarly, total vehicle sales in Apr more than doubled from a twelvemonth prior, which is leading to empty dealer lots. The combination of a fasten in consumer demand and a supply chain that is not fully operational has contributed to ascension prices.

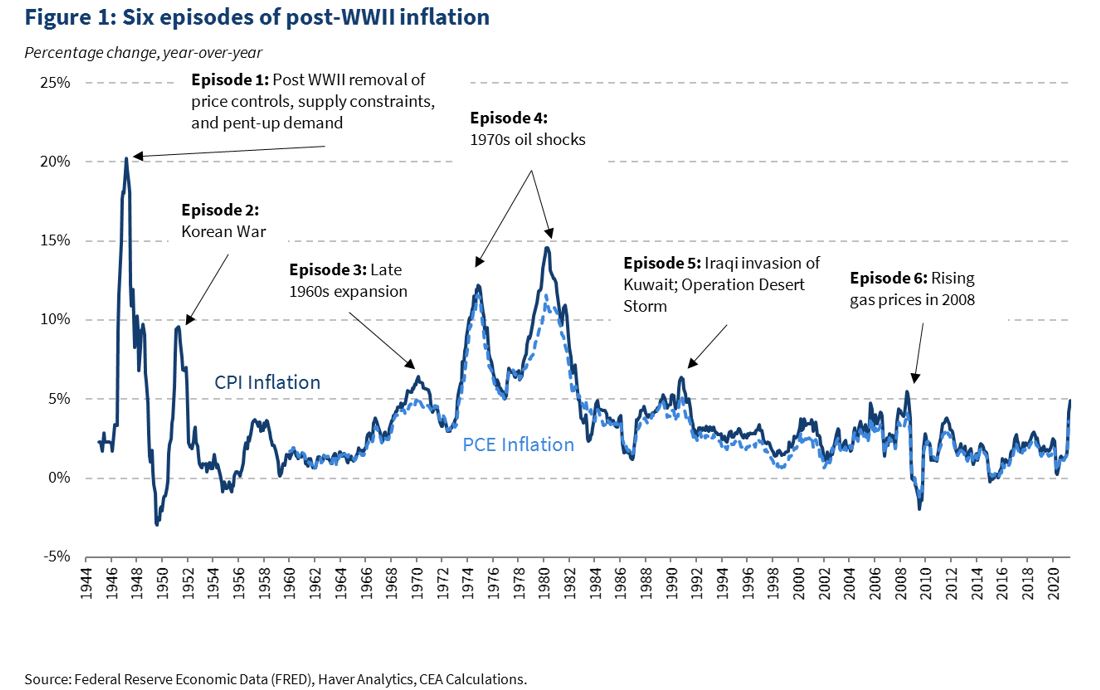

In this weblog mail, we examine previous periods of heightened inflation and see what they can teach us about inflation in 2021. Effigy 1 shows a fourth dimension series of 2 normally used measures of inflation: Consumer Price Index (CPI) and Personal Consumption Expenditures (PCE). Since World War II, there accept been six periods in which inflation—as measured by CPI—was 5 percent or higher. This occurred in 1946–48, 1950–51, 1969–71, 1973–82, and 2008. We kickoff nowadays a high-level overview of each of the previous six inflationary episodes and then turn our attention to the years following World War II—an episode that has strong similarities to what is occurring in the current environment.

Six Inflationary Episodes

Episode 1: July 1946–October 1948

Milton Friedman and Anna Jacobson Schwartz (1980) observe that World War II ushered in a period of aggrandizement comparable to the inflationary episodes that occurred during the Civil War and Earth War I.[ane] Prices also surged after Earth War 2 concluded. In 1947, inflation jumped to over twenty percent, equally shown in Figure ane. Co-ordinate to the Bureau of Labor Statistics (BLS), the rapid post-state of war inflationary episode was caused by the elimination of price controls, supply shortages, and pent-up need.

Episode 2: December 1950–Dec 1951

The Korean War started in June 1950 and hostilities ceased in July 1953. Prices had been declining in the months prior to the state of war considering of a mild recession, simply rebounded with the return to wartime condition. Demand jumped as households—reminded of rationing and supply shortages during World War 2—rushed to buy goods. In addition, some consumer production shifted back to military textile, and cost controls were reinstated. Notably, in the mail-Korean War years, when toll controls were removed, inflation did not jump the style it did following Earth War Ii.

Episode 3: March 1969–January 1971

This inflationary episode was caused past a booming economy, which increased prices. From 1965 through 1969, for instance, real quarterly Gdp growth averaged 4.8 percent at an annual rate. Inflation cruel later on President Nixon instituted a freeze on wages and prices.

Episode four: April 1973–October 1982

In the 1970s, the United states experienced its longest stretch of heightened inflation because of two surges in oil prices. The first was acquired by an oil embargo implemented by the System of Arab Petroleum Exporting Countries (OPEC). The second surge was caused by a refuse in oil product due to the Iranian Revolution and the Iran–Iraq War. In 1979, Paul Volcker became the Chair of the Federal Reserve and began his well-known entrada of hiking involvement rates to bring inflation under control.

Episode 5: April 1989–May 1991

This fifth inflationary episode occurred when Republic of iraq invaded Kuwait, leading to the kickoff Gulf War. The toll of crude oil increased significantly due to heightened uncertainty, leading to a short tour of loftier inflation.

Episode half-dozen: July 2008–August 2008

In 2008, the CPI rose above v per centum for 2 months due to skyrocketing gas prices. One barrel of West Texas Intermediate rough oil cost more $140 in July 2008 compared to $70 just a year earlier.

Pent-upwards demand and supply chain disruptions

The 3 most contempo inflationary episodes were largely a function of oil shocks; in contrast, pandemic price dynamics take not been primarily driven past oil supply, though nosotros continue to closely monitor ongoing energy price behavior. In addition, oil prices have a different human relationship with the American economy than in the by, as the U.s. became a net almanac petroleum exporter in 2020 and uses an increasing share of renewables for its energy consumption. The episode from 1969–71 is also different because the economy was growing quickly at nearly five percent per year for half a decade, which is not the case at present. The episode during the Korean War is a closer comparison, as households rushed to purchase goods in anticipation of a supply shortage. While households are consuming more than today in the aftermath of COVID due to pent-upwardly need, they are non hoarding in anticipation of a supply shortage. Also, while many industries face supply constraints, in that location is not a broad button to shift production away from consumer appurtenances.

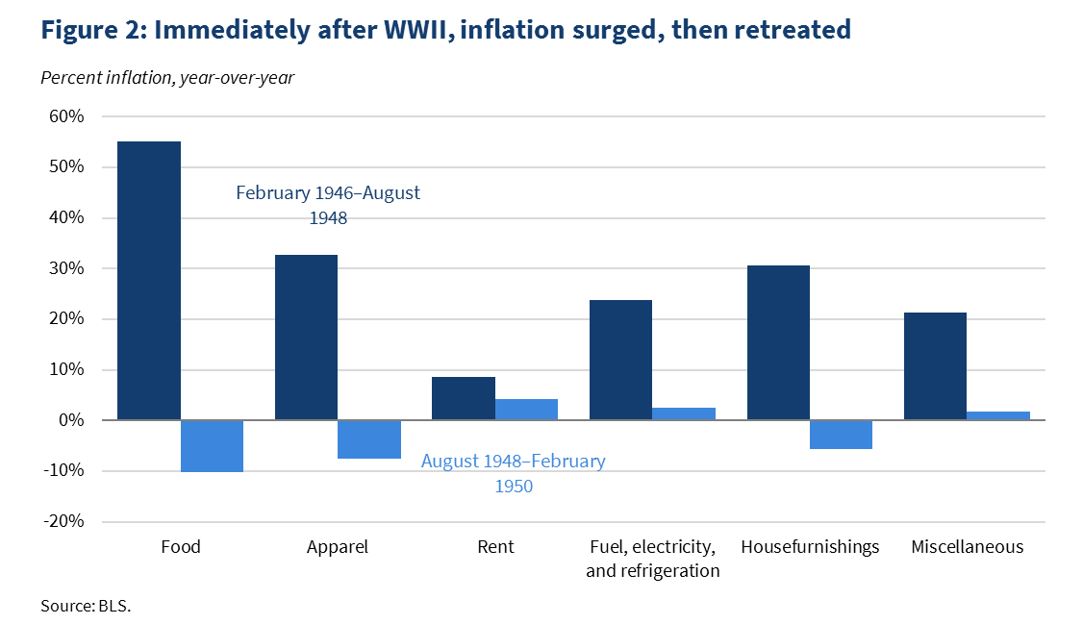

The period right after Globe War II potentially provides the about relevant case study, as the rapid post-state of war inflationary episode was acquired by the elimination of price controls, supply shortages, and pent-upward need. Figure 2 shows the change in prices in the v years following World State of war Ii.

Not surprisingly, supplies were running low or were wearied entirely during the war. Families had trouble buying cars and household appliances considering they were essentially unavailable. Co-ordinate to the BLS, "[past] 1943, many durable goods, such as refrigerators and radios, were also dropped from the [CPI] as their stocks were exhausted." Instead of focusing on consumer or industrial durable goods, manufacturing capabilities were full-bodied on military production. Today's shortage of durable appurtenances is similar—a national crisis necessitated disrupting normal production processes. Instead of redirecting resources to back up a war effort, however, manufacturing capabilities were temporarily shut downwardly or reduced to avoid COVID contagion.

Pent-up need also put upward pressure on prices following World War II. During the state of war, households were limited past the widespread rationing of consumer goods. The government rationed foods such as sugar, java, meat, and cheese as well as durable goods similar automobiles, tires, gasoline, and shoes. Personal savings increased significantly and were spent soon after the war ended. Between 1945 and 1949, a population of roughly 140 million Americans purchased xx meg refrigerators, 21.4 million cars, and 5.5 meg stoves. During COVID, businesses were shut down and households mostly stayed indoors. Expenditures on amusement, dining at restaurants, and travel fell dramatically (from March twenty–26, 2020, the entire U.S. box function made roughly $5,000 equally compared to $200 1000000 during the same week in 2019). Personal savings increased during the pandemic as well, and now retail sales are booming.

One substantial departure betwixt the inflation dynamics of World War Ii and today is that price controls were a wartime policy tool that were not implemented during COVID. Those cost controls reduced the cost level 30 percent below what it would have been otherwise, according to Paul Evans (1982). When the caps were lifted in 1946, prices climbed significantly. For example, food prices lonely rose 13.8 pct in July afterwards food cost controls expired on June 30th.

According to Benjamin Caplan (1956), the inflationary episode later World War Ii ended later two years as domestic and strange supply chains normalized and consumer demand began to level off. (Caplan also observes that private stock-still investment started to turn down, which contributed to the decline in prices and caused the economic system to fall into a mild recession, with real Gdp declining by one.5 percent).

The role of expectations

If bodily inflation is affected by inflation expectations—and if expectations are in function formed past recent experiences (what economists phone call "adaptive" expectations)—then i risk is that transitory supply constraints and pent-up demand could have more persistent effects past raising longer-run expectations of inflation. On the other mitt, businesses and consumers may "come across through" supply disruptions and not change their longer-run expectations significantly.

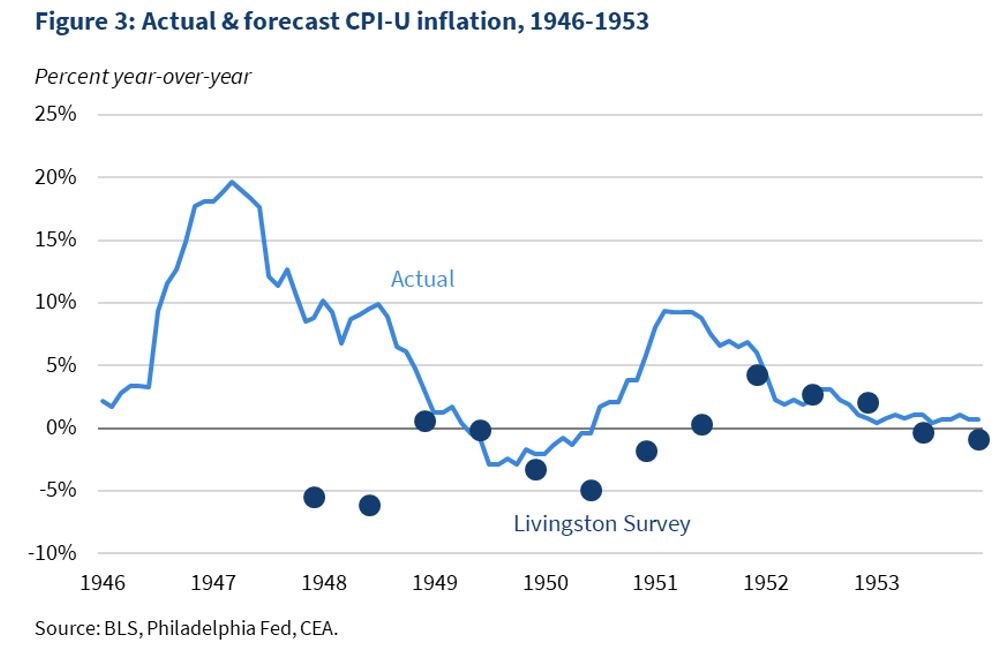

The United States of 1946 did not have near equally many ways of gauging aggrandizement expectations as we practice today, merely the express information we accept suggest Americans at the time were aware of the transitory nature of their inflationary episode. The Livingston Survey of economic forecasters—begun in June 1946 by a columnist for the Philadelphia Inquirer and run today by the Federal Reserve Depository financial institution of Philadelphia—shows that forecasters expected depression or fifty-fifty negative inflation over the 1947–1951 menstruum (see Effigy 3 below). While actual inflation often came in higher during this time—and early on expectations surveys like Livingston should be interpreted with caution due to difficulties in knowing how respondents were calibrating their expectations—respondents did not appear to persistently mark up their short-run aggrandizement forecasts due to the transitory aggrandizement episodes of World War II and the Korean War.

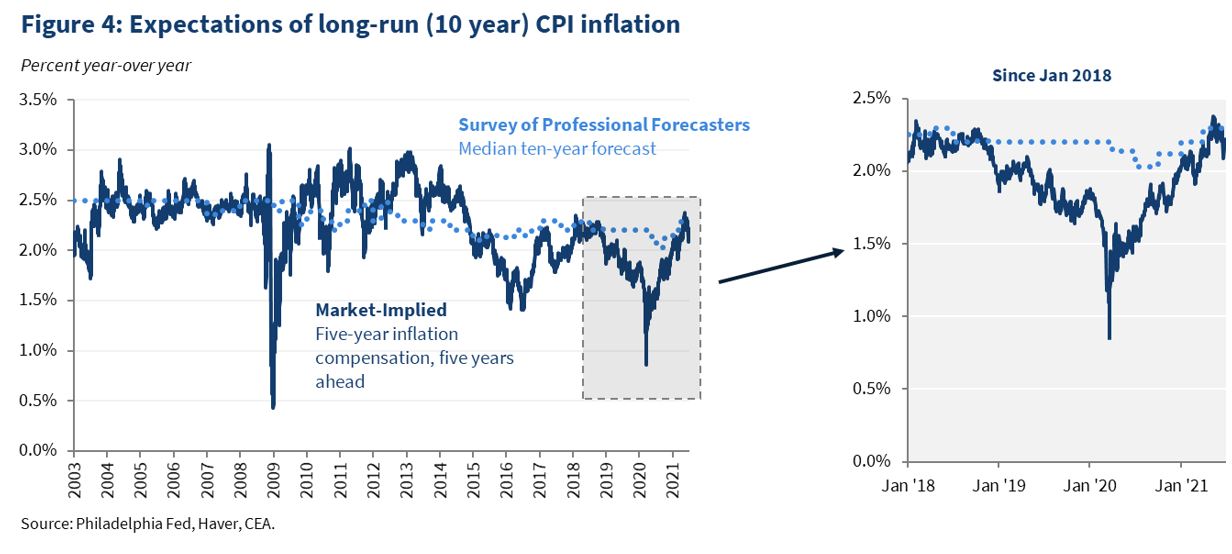

Today, nosotros have metrics measuring longer-run inflation expectations in the course of surveys and market-based measures. If transitory inflation pressures were spilling over into longer-run expectations, we would anticipate seeing these measures rise to historically high levels. However, as Effigy iv below shows, both market-based measures like the five-year, five-year inflation pause-evens, and survey-based measures like the x-year expectations in the Survey of Professional Forecasters, have broadly recovered from pandemic-lows to levels more consistent with pre-pandemic expectations.

Determination

No single historical episode is a perfect template for electric current events. But when looking for historical parallels, it is useful to concentrate on inflationary episodes that contained supply chain disruptions and a spike in consumer demand subsequently a period of temporary suppression. The inflationary period later on Earth War II is likely a better comparison for the current economic state of affairs than the 1970s and suggests that aggrandizement could speedily decline one time supply chains are fully online and pent-up demand levels off. The CEA will go on to carefully gauge the trajectory of inflation.

[ane] Due to limitations in comparable CPI data, our analysis begins at the cease of Globe State of war 2.

fishbournemoothoung.blogspot.com

Source: https://www.whitehouse.gov/cea/written-materials/2021/07/06/historical-parallels-to-todays-inflationary-episode/

0 Response to "What Event Changed Jeffery s World Again on Dec 30th"

Post a Comment